The Financial Services Labour Market Since Covid-19

Delta has summarised some key data points on the impact of COVID-19 on the Financial Services Labour Market

More questions than answers

Q. How has Covid-19 impacted the labour market since it became a pandemic and the world went into lockdown? Real Economy and Corporate Earnings are severely impacted moving from an initial liquidity to solvency crisis. 70% consumer economy with unemployment at 36 million [1]

Q. What will this to do to bank balance sheets and willingness to lend? Bankruptcies are looming [2]

Q. Will financial institutions pause hiring and firing? Morgan Stanley pledged no job cuts this year [3]

Q. How sustainable are no job cuts pledges? This ossifies an institution’s ability to hire. Will there be management support to increase cost base when unemployment has become such a mainstream concern?

Q. Who is well positioned to benefit ? FinTech, Private Equity & Family Offices [4]

2020 Q2 STATE OF PLAY

EPISODIC BUSINESSES ARE STALLED WHILE VOLATILITY SOARED

M&A is challenged in the Covid-19 environment :

- Reasonably valued and stable stock market but

- There is not a high availability of credit

- No reasonable sense of where the economy is going

- Lack of confidence in CEOs

For example, Advent International announced that it would not be closing its $1.9 billion acquisition of Forescout Technologies. As a result, Forescout Technologies’ stock price dropped by 20.43% in pre-market trading on Monday 18th May 2020, valuing the company $450 million less than Advent agreed to pay for the cybersecurity vendor in early February [5]. However, on the positive side, trading flows are up fed by the volatility [6]

FLIGHT TO QUALITY

Clients flight to quality whether they are UHNW or Institutional are stress testing their relationships[7] with service providers. A quick look at the 5-year CDS spread indicates this with UBS at 59.5bps vs UniCredit at 174bps

Litigation lurks. When Stock Markets plunged over 20% in February and March some bankers liquidated their client’s debt financed positions, imposing heavy losses. Investor enquiries relating to margin calls are up over 400%, with lawyers arguing the point that some bankers were too inflexible in refinancing investments. Moving accounts has been increasingly difficult and rare at the end of the previous cycle and we believe that the flight to quality will change this, benefiting those with a clear value proposition

Investments in technology have also paid off for clients that are able to offer a seamless service despite the Covid-19 restrictions. Ability to advise clients on protecting and strengthening their balance sheet and restructure assets while working remotely has been key for platforms to maintain the requisite level of service and hand holding in this unprecedented time

WEALTH TRANSFER

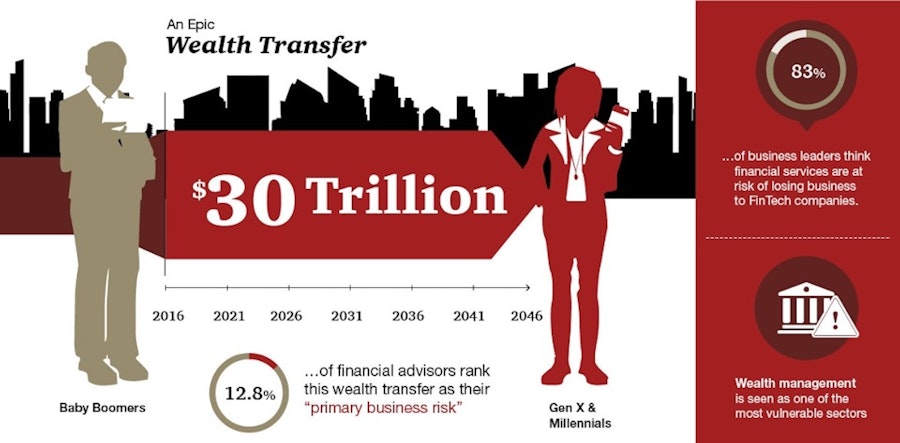

The inter-generational Wealth Transfer of $30 trillion over the next 30 years will be the largest in history. 1 in 8 “financial advisors rank this wealth transfer as their primary business risk”

‘Millennials’ are vastly different to the ‘Baby Boomer’ generation. Their symbiotic relationships with technology, an inherent distrust of financial institutions and a change in life priorities, is forcing financial sectors, especially Wealth Management, to change their traditional approach in order to survive the challenge of FinTech and Private Equity

Figure 1 [8]

“In that wonderful, bygone, sunlit age, back at the start of February, data from Preqin, Dealogic and other sources suggested that across funds dedicated to buyouts of established companies; venture capital to support growth; dedicated infrastructure, real estate, special opportunities and distressed funds, managers of Private Equity had more than $2 trillion of dry powder – money that had been raised in large rounds of fund raising but not yet invested” [9]

HIRING TRENDS - NOW

Candidates that were already in a hiring process pre COVID-19 and had the benefit of having some interviews conducted in person with key stakeholders in their target institution pre lockdown are progressing to final stages, receiving competitive offers and are being hired (see Delta’s latest Market Update here)

These candidates tend to be more senior strategic hires that are key to strengthening the target client platforms in the short term. In the current market of ‘team moves’ the latter are typically joined by trusted colleagues to maximise client onboarding and franchise building in an already competitive environment

The physical implications of a lockdown mean that face to face interviewing ground to a halt and slowly migrated to online channels, with hiring managers reluctant to hire, outside of critical business need, when they can’t meet candidates face to face

Managers managing Managers find themselves in a precarious position as vertical decision making makes them redundant. Player managers with strong client connectivity who are perceived as enablers and can manage cross border assets sans travel are best positioned in the current environment

Bankers hired on formulas with KPI’s locked into compensation for 2020 will find it difficult to deliver if they are not benefiting from the flight to quality trend. This may push non-strategic hires into 2021, as a result creating a buyer’s market over the next 6 to 12 months. Furthermore, 6 month gardening leave for a big percentage of key strategic hires, has made hiring a medium term exercise for banks

Junior Bankers are being disproportionately affected by Covid-19, as their survival within their respective firms is largely dependant on deal flow. This has therefore caused an exodus of Analysts and Junior Associates from their respective institutions

There are also early signs of a switch back to Hedge Funds, with some performing better than Long-Only Funds and ETF’s, given their ability to redeem in a shorter window than Private Equity, which has a significantly longer lock-up period. Having said that, some of the largest Hedge Funds have performed poorly seeing double-digit losses amid overall sharp market declines which were triggered by the coronavirus outbreak, however we will only be sure when redemption data will be published at the end of June

HIRING TRENDS - GOING FORWARD

There are clear physical implications of the lockdown on client coverage models as we deglobalize more rapidly into COVID-19 with not only businesses actively looking into institutionalising their remote working set ups, but also bankers themselves looking for opportunities to relocate closer to family. Personal reasons being the key driver. Furthermore, tax hikes in hub jurisdictions like New York City and London, could lead to an exodus to lower tax geographies

With the pandemic “greasing the wheels for big tech’s entrée into higher education…with hundreds if not thousands, of brick-and-mortar universities likely to be going out of business"[10], this further begs the question of whether e-learning will further reduce the need to be based in hub cities altogether

During the last part of the previous cycle, coverage models were hub over spoke, with restrictions on travel and a focus on unified execution pools. Institutions will need to decide which geographies are core strategically and then deploy senior personnel locally. At least for the period this continues, we are likely to return to a local coverage model with international execution for these selected geographies

Bulge brackets are likely to retrench coverage to only the top corporate and individual names with a significant portion of the market being deemphasized. The latter will see increased presence from non-bank financial institutions, credit and distressed funds, that will likely fill the breach. Typically these would include exporters that earn in USD and have fixed costs in local currencies or scalable FinTech operations [11]

Currency volatility will mean significant turbulence for the Emerging Markets with clients turning to the most sophisticated advisors on the ground, leading to local champions becoming hirers of choice and global players retreating to only cover the largest and most sophisticated clients. We have already seen the likes of UBS reorganise their wealth management business in a bid to speed up decision-making and strengthen regional units [12]. This currency volatility is exacerbating fund flows out of EM and is likely to cause further capital controls which in turn will create demand for more sophisticated structuring capabilities to help UHNW UBOs and local entities navigate the current environment

Over 60 financial services firms have already moved to Luxembourg with several others looking to establish their presence in Luxembourg in a bid to “insulate themselves from the effects of Brexit”[13] in light of the uncertainty of any future trade deal between the UK and the European Union. The country’s strong reputation for financial services and beneficial regulatory requirements will encourage more platforms to grow their European operations there post Brexit and Covid-19

HIRING TRENDS - YEAR ON YEAR

Comparing notable hiring activity year on year, there has been a clear decrease in the number of completed placements observed by Delta Executive Search and Delta Emerging Markets AG across front office financial services by at least 5% in April 2020 vis a vis April 2019

When analysing internal statistics around hiring processes across financial services, it is evident that the total number of external hires has decreased across product area. Clients have struggled to justify additional headcount allocations in an environment where they have already seen a significantly lower number of voluntary departures post bonus announcements than anticipated with employees more concerned about job security, leaving a net surplus of headcount than initially budgeted for the year

As a result any new hire is being thoroughly scrutinised by senior management leading to a significant increase in the average hiring process duration in product areas where strategic hires remain key for business development, such as Wealth Management, despite market turmoil

For the Delta house view and related mandates please reach out to the team at info@deltaexec.com or call us on +44 (0)20 7427 6300

Best Regards,

Delta Executive Search Team

Tags

Recent Blog Posts

Join our mailing list

Keep up to date with our mandates and blog posts.